With a new year comes new rules. Here are some of the biggest you should know about.

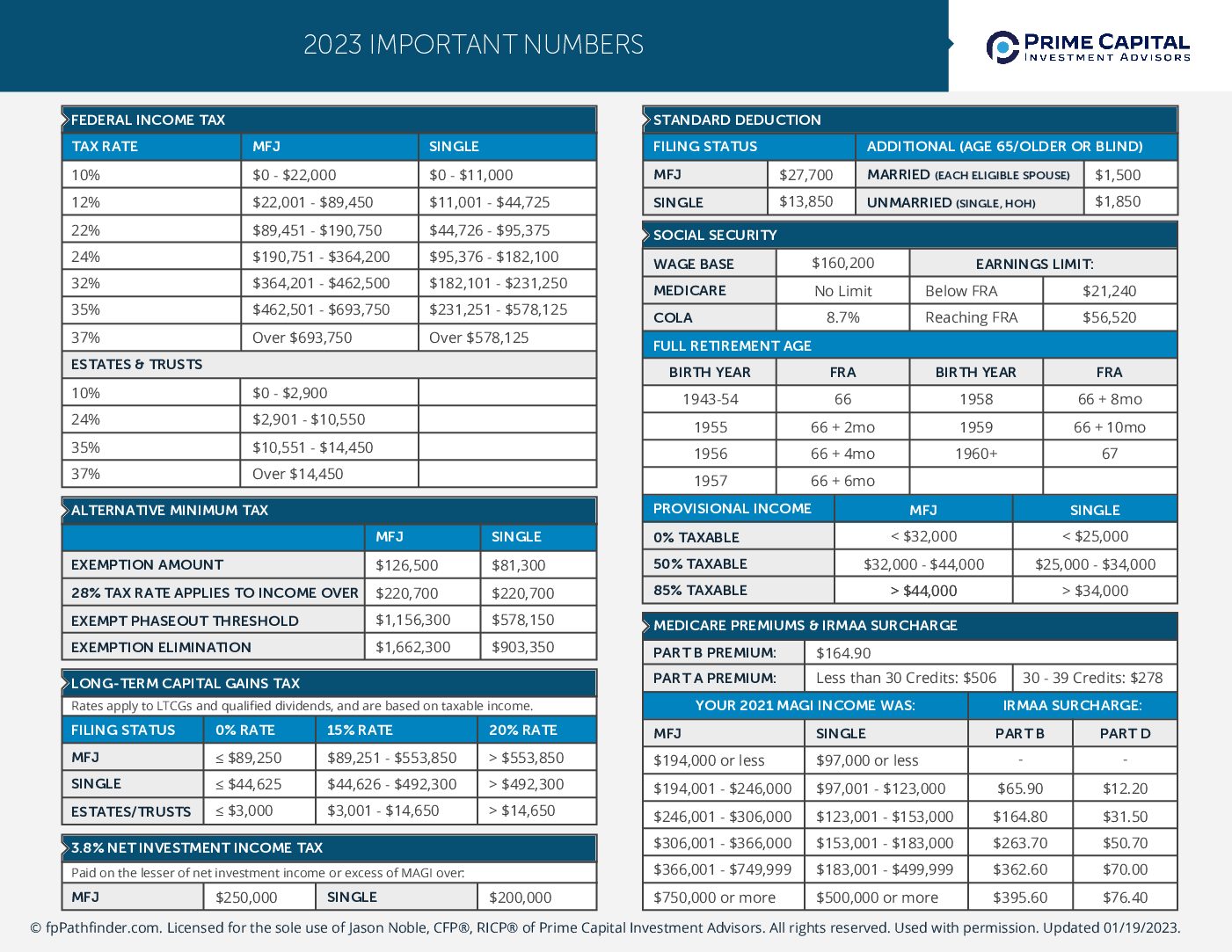

We have tax changes in 2023 and an update from the Secure Act 2.0. These updates bring big changes for folks from every phase and stage of their retirement planning journey. In case you missed the news, don’t worry because I’ve got the highlights for you. At the bottom of this newsletter, there is a document you can download that has 2023 Important Numbers!

Higher Contribution Limits for Retirement Plans

Good news for retirement savers in 2023: Contribution limits are higher. Caps for employees participating in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan are now $22,500. For those over 50, your max contribution is $30,000! Go into your payroll to ensure you make these adjustments to take advantage of these higher limits.

Additionally, the annual contribution limit on IRAs has increased to $6,500, or, with catch-up contributions for savers over 50, $7,500. Don’t hesitate to contact us to discuss how to make these changes in your IRAs.

Income brackets and withholdings

You may already benefit from one of the IRS’s biggest changes. If you noticed a bump in your net pay after January first, there’s a good chance it’s connected to the package of adjustments made to federal income tax brackets and standard deductions by the tax agency.

The updated IRS tax tables establish how much employers should be withholding for federal taxes. The increase of brackets means withholdings should go down, resulting in workers getting a bump in their take-home pay.

Tax Deductions are Going Up

Standard deductions are going up. Though the effect may not be fully felt until you file your 2023 taxes early next year, taxpayers will get some relief. Married couples filing jointly will see a standard deduction of $27,700. The deduction for single taxpayers is also increased up to $13,850. There are additional standard deductions for those who are blind or over the age of 65.

Here are the major updates from the Secure Act 2.0, which was passed on December 29, 2022. Please know that more updates are coming in the next few years, and more are set to come down the road!

- Catch-Up Contributions

-

- For employer-sponsored plans, the existing catch-up contributions of $7,500 remain in place for those who are 50 and older.

- In 2025, there is an increase for those ages 60 to 63, as the annual catch-up amount increases to the greater of $10,000 or 150% more than the standard catch-up amount in 2024. More is to come as time moves forward, but also know the higher limit would be indexed for inflation in future years!

- Starting in 2024, for those who make over $145,000, all catch-up contributions to employer-sponsored plans must be made to Roth accounts. Under former IRS rules, contributions can be made on either a pre-tax or Roth basis (if permitted by the plan sponsor).

- For IRAs, the catch-up stays at $1,000 for individuals 50 and older. Starting in 2024, the $1,000 catch-up will be adjusted annually for inflation.

- Minimum Mandatory Distribution Age

This applies to all of the following accounts:

-

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- Rollover IRAs

- Most 401(k) and 403(b) plans

- Most small-business accounts

In 2023, the age will be raised from 72 to 73. To provide some context, RMDs began at age 70.5 from 1986 through 2019. In 2020, it jumped to 72 years old, and now in 2023 and for the next nine years, it will be age 73.

It is best to determine your RMD start age based on your birth year:

-

- 1950 or Earlier: RMDs start at age 72.

- 1951 to 1959: RMDs start at age 73.

- 1960 or later: RMDs start at age 75.

- For those considering Roth conversions, this change in the RMD age can have meaningful impacts on your strategy!

- Reduced Penalty for Failure to Take Required Minimum Distributions (RMDs)

The excise tax penalty of 50% for failure to take RMDs is now 25%. For IRAs, the tax is further reduced to 10% if corrected in a timely manner. Reduction is effective as of the bill’s signing.

-

- Qualified Charitable Distributions (QCD) – For those who are charitably inclined, QCDs can be counted toward satisfying your (RMDs) for the year, as long as certain rules are met. A QCD is a direct transfer of funds from your IRA custodian (Schwab/Fidelity), payable to a qualified charity.

- Required Automatic 401(k) Enrollment

-

- It’s important to note that these adjustments are only for newly established 401(k)s. These do not apply to already established 401(k)s.

Requiring automatic 401(k) enrollment: Employers would be required to automatically enroll employees in their 401(k) plan at a rate of at least 3% but not more than 10%.

Businesses with 10 or fewer workers and new companies in business for less than three years are among those that would be excluded from the mandate.

- Tax and Penalty-Free Rollover from 529 to Roth IRA

Beneficiaries of 529 college savings accounts are permitted to roll over up to $35,000 from a 529 account in their name to a Roth IRA account. Rollovers are subject to IRA annual contribution limits and are available for 529 accounts that have been open for more than 15 years. Rollovers are permitted starting in 2024.

For all of the latest figures for 2023, you can click below to download our chart of important numbers for the year!

If you have any questions about how these changes impact your financial plan, click here to schedule a conversation with me, or call our office at (843) 743-2926. We are here to help and looking forward to hearing from you!

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite 150, Overland Park, KS 66211. PCIA doing business as Qualified Plan Advisors (“QPA”) and Prime Capital Wealth Management (“PCWM”).

022123001 MKS; 011823006 MKS; 012623004 MKS

Prime Capital Investment Advisors, LLC (“PCIA”) and its associates do not render any legal, tax, or accounting advice nor prepare any legal documents. Client understands that his (her) personal attorney shall be solely responsible for the rendering and/or preparation of the following: (i) All legal advice, (ii) All legal opinions and determinations, and (iii) All legal documents. Client understands that his (her) personal accountant shall be solely responsible for the rendering and/or preparation of the following: (i) All accounting advice, (ii) All accounting opinions and determinations (iii) All accounting documents.